A Step-by-Step Guide to Managing Loaner Vehicles Efficiently

Running a loaner program shouldn’t feel like herding cats. But let’s be real, for many of you, it does.

Cars disappear for days, paperwork piles up, small charges are forgotten and end up hurting your margin. Meanwhile, manufacturers are watching your CSI scores like hawks.

The truth is, loaner vehicles aren’t just a courtesy anymore. They can make or break your CSI scores, your OEM compliance, and your bottom line. Managed poorly, they drain your time, money, and patience. Managed well, they free up your staff, keep your customers happy, and even boost your profit.

In this guide, we’ll break down how to take control of your loaner fleet-step by step-so it works for you, not against you.

Why Loaner Vehicles are More Important Than Ever for Car Dealerships

The game has changed. It’s not just about moving metal off the showroom floor anymore. The real, sustainable profit? It’s coming from your service bay.

-

Your Service Bay is a Profit Powerhouse: According to NADA and Cox Automotive, fixed operations now contribute over 50% of a dealership’s gross profit, making service revenue the true engine of profitability. Fixed ops are now pulling in nearly half of a dealership’s gross profit. With people keeping their cars longer than ever. We’re talking an average of 6.5 years now. The demand for service is only going up.

-

Service Drives Sales (Seriously): You want to sell more cars? Keep your service customers happy. A whopping 74% of customers who service their car with you are likely to walk right back through your doors when it’s time to buy a new one. A loaner vehicle can be the difference between a happy customer and one who never comes back.

-

You’re Busier Than Ever: With record service volumes and a constant flood of recalls, your bays are packed. Loaners are your lifeline to keep customers on the road and happy when their car is tied up for a few days.

-

The Big Guys Are Watching: For many of you, especially with high-line brands, the manufacturer requires you to have a loaner program. They’ll even subsidize the fleet because they know it’s key to keeping customers loyal to the brand.

A loaner car isn’t just a replacement vehicle. It’s a critical tool for retention, a solution for operational stress, and a massive part of the modern customer experience.

Your Step-By-Step Guide to Mastering Your Loaner Fleet

Step 1: Ditch the Paperwork and Go Digital

Chasing signatures and deciphering insurance cards is a massive waste of time. A dedicated system, like Kimoby Go, digitizes the entire process from start to finish.

-

Digital Contracts: Let customers fill everything out on their phone-reserve the car, upload their license, and sign the agreement-before they even arrive. No more paper, no more manual errors.

-

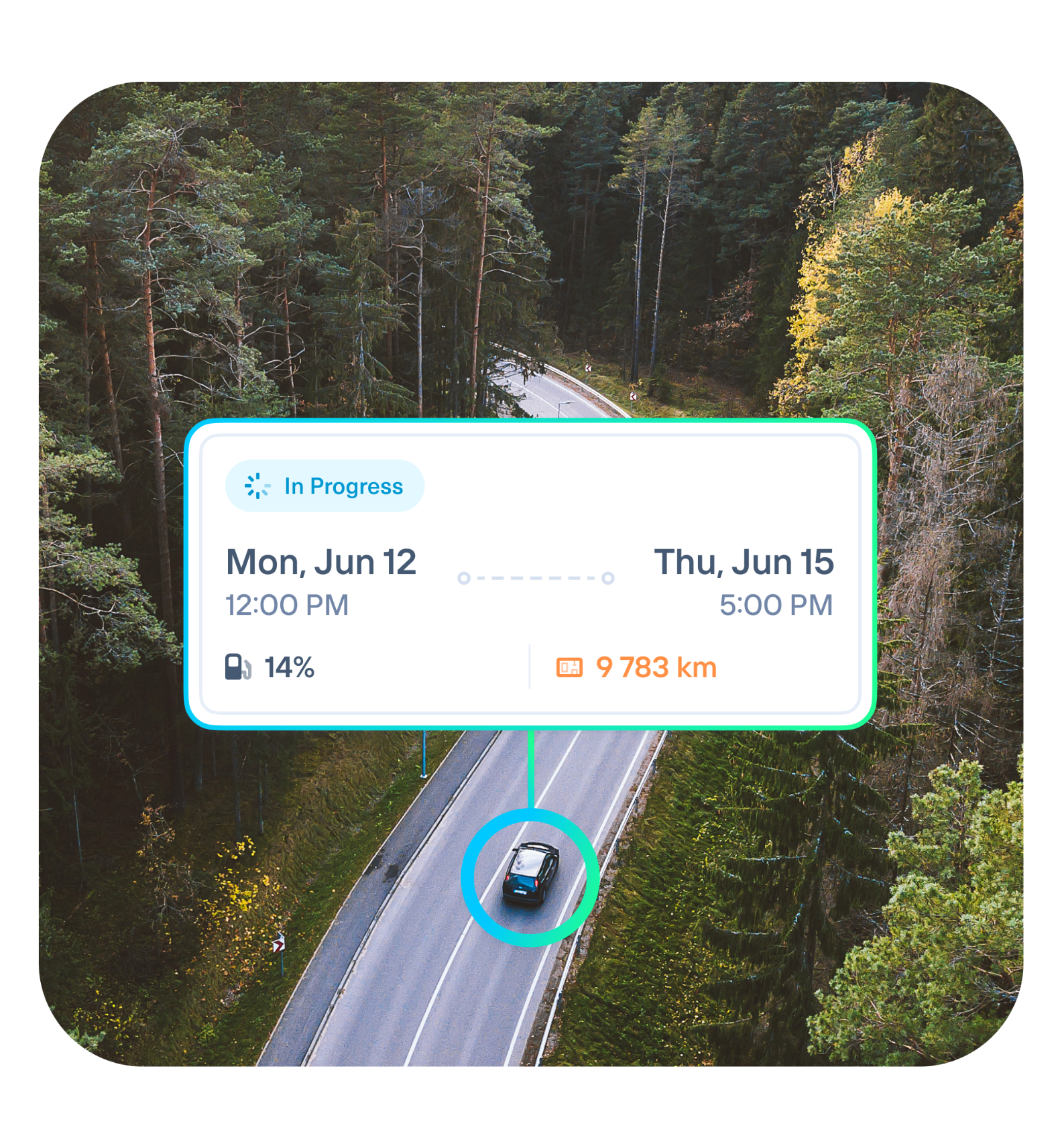

Real-Time Fleet Tracking: See the status of every single loaner on one screen. Know exactly where each car is, if it’s overdue, and its current mileage. This helps you prevent unauthorized use and stay compliant with OEM rules.

-

Instant Billing for Incidentals: This is a game-changer. When a car comes back with an empty tank or a new toll charge, you can bill the customer for it instantly. No more chasing down small amounts that add up to big losses.

Step 2: Get Cars Back on the Lot, Faster

Every day a loaner is out is money you’re not making. The goal for top-performing dealers is to keep that turnaround time under 3 days.

-

Create a Uniform Process: When every staff member follows the same digital check-in and check-out steps, things move faster and training becomes a breeze.

-

Use Data to Optimize Your Fleet: The right tech shows you which cars are sitting idle. This data helps you optimize your fleet size so you’re not paying for vehicles you don’t need. You can even pair this data with automated SMS reminders to nudge customers for on-time returns.

Step 3: Stop Losing Money on Fuel, Tolls, and Damages

Think about all the little charges that slip through the cracks. It’s death by a thousand cuts.

- Automate Cost Recovery: Digital loaner systems let you immediately log and charge for damages, extra fuel, or unpaid tolls right at check-out. Policaro Group, for instance, recovered over $680 in fees in the first week of using Kimoby Go. That’s real money going straight to your bottom line.

- Sell at the Sweet Spot: Use analytics to pinpoint the perfect time to retire a loaner, helping you maximize resale value and hit key manufacturer incentives.

Step 4: Create a Frictionless Customer Experience

The best part? A smooth, digital process makes your customers incredibly happy and boosts loyalty.

-

No More Waiting Around: Customers can book their loaner online and get SMS updates. It’s a seamless experience that shows you respect their time. For best practices on timing and tone, check our dealership texting software guide.

-

Get Instant Feedback: Automatically send a quick survey after they return the car. This gives you immediate insight into your service, helping you boost those all-important CSI scores. (Just make sure your texting process follows consent and opt-out rules).

Conclusion

Turning your loaner program from a headache into a high-performing asset doesn’t happen by accident. It happens by swapping outdated manual processes for smart, automated tools.

When you do that, you’re not just managing cars. you’re building loyalty, protecting your profits, and making your dealership run a whole lot smoother.

Frequently Asked Questions (FAQ)

What is the biggest challenge in managing a loaner fleet?

The biggest challenges are typically manual processes, tracking vehicles, and recovering costs for fuel, tolls, and damages. Digitizing the process with a loaner management system solves all three.

How can I prove the ROI of improving my loaner program?

Track key metrics like reduced administrative hours, full recovery of incidental costs (fuel, tolls), faster vehicle turnaround times (ideally under 3 days), and improved CSI scores.

Can technology really help reduce loaner vehicle abuse?

Yes. Real-time GPS tracking, mileage alerts, and digital contracts that clearly state usage policies significantly reduce unauthorized use and make drivers more accountable.

You May Also Like

These Related Stories

Loaner Fee Recovery: How to Protect Your Fleet and Your Profit

/photo_honda_toyota_seattle_busy_service.png)

Car Dealership Fixed Operations Guide for Management