Loaner Fee Recovery: How to Protect Your Fleet and Your Profit

Loaner Fee Recovery: How to Protect Your Fleet and Your Profit

Loaner vehicles are an amazing customer service tool in your facility. A tremendous customer satisfaction booster for those big-dollar multi-day repairs. It can even be the key to customer loyalty and retention.

For many luxury brands, it is often an OEM requirement as well. But if you’ve ever run a fleet, you know there’s a flip side to the coin.

Loaners can be expensive to purchase or acquire, maintain, and insure. They can be a magnet for the unexpected. We’ve all seen it before:

-

The car comes back in worse shape than when it left.

-

The customer forgets to return it after a week.

-

The insurance claim gets declined because of some non consequential mistake on the loaner agreement.

It’s a real headache for your fixed ops departments revenue. The good news is, you can get ahead of this problem.

Loaner fee recovery is not just about charging your customers a couple of bucks to fill the tank. It’s about putting in place a system that transforms courtesy vehicles into a customer retention tool that pays for itself.

So, let’s look at how to recover your costs and protect your asset.

What Are the Recoverable Costs on Your Loaner Fleet?

First off, let’s clarify what you should be charging for. You want to have a documented policy in place that protects the dealership. Your loaner agreement is your weapon of choice here.

Here are the fees that should be built into your policy, with a credit card on file to cover them.

-

Daily usage fee: If a customer forgets to return the vehicle within 24 hours of the completion date of the repair, it is no longer a loaner. You should charge a daily fee, something like $59.95 a day. You want to create that sense of urgency.

-

Fuel: The vehicle needs to come back with the same amount of fuel as when it left the lot. If it does not, you should charge for the missing fuel amount.

-

Detailing fees: Is your loaner a non-smoker vehicle, and you get it back smelling like an ashtray? A detailing fee of $399.95 to clean it up is absolutely justified. Same thing if the vehicle comes back with the cabin looking like a pigsty.

-

Damage repair charges: Drivers are responsible for any damage caused during their loan. We’re talking tire and wheel damage, chips in the windshield, scratches and dents, you name it. Make sure you state clearly in the agreement what the deductible is for the driver. (Shocker: it could be as high as $10,000.00.)

-

Tolls tickets and penalties: This has to be clearly spelled out. Drivers are responsible for any of those during their loan. Your agreement has to state clearly that their credit card will be charged for any violation that comes back to the dealership. No vagueness allowed here!

Bonus: Many OEMs offer you subsidies for your loaners (1% of retail value for your whole fleet each month) to offset depreciation rate. Know your programs, and take advantage of them. It’s free money if you’re managing your fleet properly.

Loaner Program Fees Recovery Calculator

Let's look at the common fees and what you can recover each month based purely on the cost of the item itself.

Step 1: Inputs

Your Loaner Leak Recovery Report

Your Total Monthly Loaner Contracts

( × ) =

Monthly Fuel Recovery

Assuming 30% of customers don’t return with a full tank and the average cost is $27.35

( × × ) =

Monthly Toll & Ticket Recovery

Assuming 10% of customers incur tolls or tickets

( × × ) =

Monthly Minor Damage Recovery

Assuming 1.5% of customers return cars with minor damage

( × × ) =

Monthly Late Return Recovery

Assuming 15% of customers return one day late

( × × ) =

Best Strategies to Recover Loaner Fees

Now that we’ve covered what you can charge for, how do we go about collecting all those fees, and what can you do to avoid those nasty surprises in the first place?

1. Clear & Complete Loaner Agreements

If you take nothing else out of this, let it be this: Your loaner agreement is everything. A wrong or incomplete form is the number one reason why your insurance claims get declined. Make sure your agreements:

-

List all charges, responsibilities, and return policies.

-

Are the most up-to-date form required by your insurance provider and OEM for the subsidies.

-

Are 100% complete: driver’s license information, proof of insurance with current dates, full vehicle VIN, no exceptions.

-

Include a required return date linked with the completion of the RO. Without this in place, you’re going to find yourself in a situation where the police will not want to put an unreturned vehicle as stolen.

-

Follow your policy’s maximum day limit (for instance: 30 days). If the repair takes longer than that, have the customer come in and return the vehicle, and have them sign another agreement.

2. Have Quick Service Operations

The shorter the time between having the repair vehicle back and having the loaner returned to its designated spot on the lot, the shorter the time it’s out on the road racking up wear and tear, and headaches. It’s the fastest way to cut costs on your fleet.

-

Your loaners should not be out for more than 3 days. I’ve personally seen one case study where the dealer managed to cut their annual loaner costs from $94,000.00 down to just $11,000.00. Now, they were paying a rental company for the service, so their cost was direct dollar-for-dollar. But the principle is exactly the same for your own fleet. Cutting just one day off your average loaner cycle means less fuel to purchase, less maintenance, lower mileage on resale, and a lower risk of the vehicle getting broken or something going wrong with it altogether.

-

Your policy should state the following: Customers should provide authorization to the repair order within 24 hours of contact, if they’re slow in coming forward, charge them rental rates.

-

Your customer vehicle is waiting to be repaired upon arrival because it’s safe to drive and waiting on parts? Have them swing in and return it and have them come back and get it when the part is in.

-

When the loaner vehicle comes back, do your final walk-around with the customer. Verify the level of fuel and do a quick walk-around checking for any damages before they sign-off. It only takes a minute or two and can save you all kinds of “he said, she said” later on.

3. Have Clear Eligibility Policies

Not every service appointment calls for a loaner vehicle. You need to be clear on your eligibility policies.

- Are they only for customers that own the vehicle?

- Are they only available for repairs exceeding two hours?

- Are they not available for light maintenance and collision work?

Whatever it is, define it, write it down, and stick to it.

Have the customer schedule an appointment at the same time they’re booking the loaner appointment. This way, you can manage the availability, and you’re not promising a vehicle for the next customer that would not be available otherwise.

How to Track Loaners’ Costs & Compliance

Now that we’ve covered the policies and the strategies to implement, how do you know any of this is actually working? Because you can’t manage what you can’t measure. Here’s what to keep an eye on for efficient loaner vehicles management.

Key Performance Indicators (KPI)

Instead of just managing the fleet, you need to keep track of specific metrics that will show you the true health of your loaner program.

-

Cycle time: How many average days is a loaner on the road? You shouldn’t be looking for more than 3 days.

-

Fleet utilization: Are your vehicles just sitting around not making you money? Or worse yet, are they sitting around so little that you end up with nothing in stock to lend to the next customer? You need to know what your sweet spot is to avoid being overbooked or too far oversold.

-

Cost recovery rate: Of all the fees you should be charging for (fuel, tolls, tickets, minor damages), what percentage are you actually recovering?

-

OEM mileage compliance: This one is huge when it comes to OEM programs. Are you keeping track of the mileage like a hawk to stay on the program’s good side?

-

Loaner fleet budget: Are you on budget or overspending?

The Right Tool For The Job

Tracking all of this manually, whiteboard or spreadsheet style, is a near-impossible task. This is where having a loaner management tool built for dealerships like Kimoby can completely change the game. Instead of chasing piece of papers around, you have a dashboard in real time doing the heavy lifting for you.

Think about how different that is:

-

Clean and organized contracts: Forget lost or misfiled paper agreements. With a platform, you use digital contracts that are created, signed, and stored securely online. It even captures and organizes the driver’s license and insurance info for you.

-

Ensured damage documentation: Instead of a he-said-she-said problem when a customer brings back a car with damage, you have digital damage documentation. The platform lets you log preexisting damage with photos and timestamps before the vehicle leaves and document that same damage when it comes back.

-

Automated fee collection: The platform even lets you handle automated fuel charge collection using the credit card on file. The platform calculates the missing fuel and charges the card on file. It means you’re guaranteed to get paid in full.

-

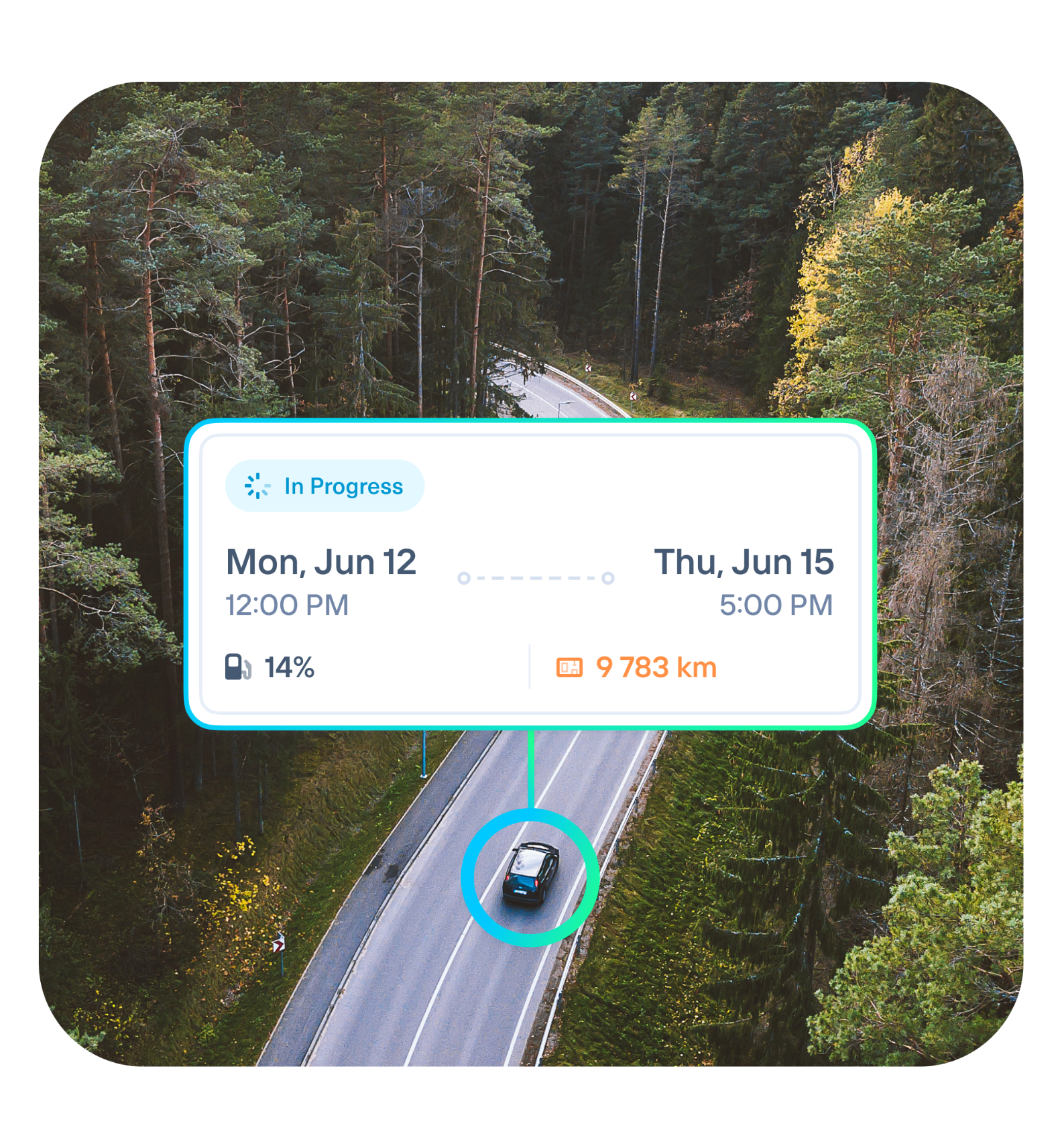

Know where your cars are: The best platforms use geofencing technology. You can set a geographic boundary and have an instant alert sent to you if a vehicle leaves that permitted area.

-

See your whole fleet at a glance: The best part is having fleet availability in real time. You get to see exactly which cars are available right now, which are out, and when they’re coming back.

-

Powerful reporting: Last but not least, it gives you the metrics to analyze your program and see where it’s working and what needs some attention.

As Francesco A. Policaro, VP of Operations, Policaro Group, it’s all about streamlining processes, recovering your costs, and improving the customer experience.

Conclusion

A loaner program is an excellent tool for customer retention, but it’s also a very expensive tool. It needs discipline. With solid agreements, tight service operations, easy-to-understand policies, and ongoing compliance monitoring, you can turn a possible money pit into a tool that contributes to your fixed ops profit.

Want to see how Kimoby can help you do this? Book a quick call now!

FAQ

Why is loaner fee recovery so important?

Loaner cars are expensive. They’re expensive to buy, extremely pricey to maintain, and an exorbitant cost to insure. Without a tight process for recovering the costs of fuel, damage, and late returns, your loaner fleet can become a money pit. A proper fee recovery plan will let you keep your customers happy without ending up in a bad place for your department’s profitability.

What fees am I entitled to charge for a loaner vehicle?

Common recoverable fees include daily usage fees for late returns, fuel charges, detailing fees for smoking or excessive dirt, damage repair fees, and tickets or tolls incurred during the loan. Always note these in your loaner agreement, and keep a credit card on file for recovery.

What’s the ideal way to avoid a denied insurance claim?

Don’t give them a reason to deny your claim:

- Always use the most recent, correct form from your insurance provider.

- Make sure the agreement is 100% complete.

- Always put a firm return date down.

- Using an older form or any missing info always seems to be the fastest way to get your claim denied.

What’s the ideal turnaround time for a loaner vehicle?

Aim to have the loaners back in three days or less. Reduce the cycle time to keep down wear, reduce the mileage cost, minimize wear leads to smaller mechanical costs, and keep more loaners available for others.

Should every service customer get a loaner?

Not necessarily, and they probably shouldn’t. The best-run dealerships have a defined policy. They restrict loaners to repairs over a set time like two hours, they don’t allow them for routine maintenance, or restrict them to those customers who bought their car from them. The main point is to have a written policy and stick to it. That way there are no arguments in the service drive.

How do I report on loaner fleet performance?

Monitor Key Performance Indicators (KPIs) like average cycle time, fleet utilization, costs recovery rate, and OEM mileage compliance. Don’t try to do this reporting on a spreadsheet. Find a loaner management system that can automate this reporting and give you real-time and historical reporting.

What tools do I have at my disposal to help manage a loaner program?

A dedicated loaner management platform built for managing loaners like Kimoby. Providing digital contracts, automatic fee collection, damage documentation through photos, real-time fleet visibility, and geofencing alerts will help you keep your loaner program efficient, compliant, and profitable.

You May Also Like

These Related Stories

/photo_service_advisor_customer.png)

How To Turn Declined Service to Revenue Opportunities for Your Dealership

How to Maximize Loaner Fleet Profitability