You know the scene. It’s 5:00 PM. The techs have worked hard all day on ROs, cars are lined up out the bay, and you’ve got a line of customers at the front desk who just want to pay their bill, grab their keys, and get home.

Meanwhile, your service advisors are playing phone tag trying to get credit card numbers-a security nightmare waiting to happen. Your cashier is swamped. Your customers are getting restless. And you’re looking at this daily chaos and thinking, “There has to be a better way.”

Good news: There is. It’s called text to pay.

It’s a simple tool that’s already fixing this exact headache for dealerships across the country.

What is Text to Pay?

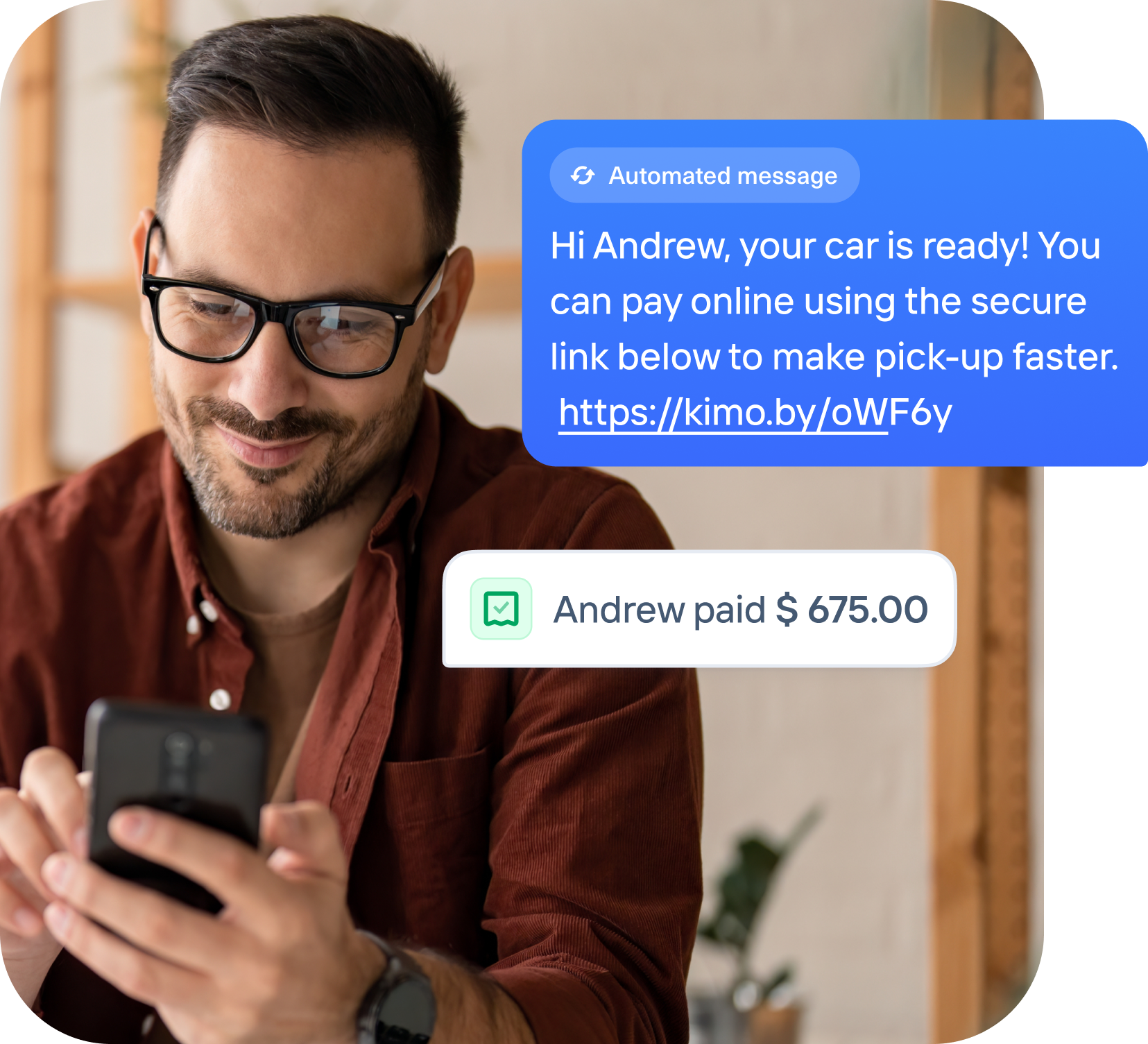

Text to pay is a system that lets you text a customer their invoice with a secure link, allowing them to pay on their phone from anywhere.

That’s it. No more playing phone tag for credit card numbers. No more lines at the cashier’s desk. It's a clear way to improve your dealership's customer communication.

Here’s how it works:

1. The Car is Ready and the RO is Done

Your technician finishes the job, and the service advisor finalizes the repair order in your DMS. Instead of picking up the phone to start the awkward “Hi, your car is ready…” conversation, they click a single button to send the invoice with a payment link.

2. The Customer Receives the Text

Wherever they are-in a meeting, at their kid’s baseball game, or on their couch-they get a simple, professional text message from your dealership with a secure link to pay their bill.

3. They Review the Invoice and Pay

The customer taps the link, which opens a clean, simple payment page right on their phone. They can see a breakdown of the invoice-no surprises. Then, they choose how to pay: Apple Pay, Google Pay, or by typing in their credit or debit card info. It takes them less than 30 seconds. They even have the option to finance their bill, all in one place.

4. You Get Paid

The second they hit “Confirm Payment,” your system gets an instant notification: PAID. A copy is logged in your system, and the repair order can be closed. The entire transaction is recorded with a clear, digital audit trail.

That’s it.

The Benefits of Using Text to Pay at Your Dealership

We get it. Hearing “new technology” can sound like “new headache.” But this is different. This is a way to make more money with less effort.

Get Paid Instantly

No more chasing payments. No more, “I’ll call you back with my card.” The second that customer hits ‘Pay’ on their phone, the money is heading to your bank account. This tightens up your cash flow and slashes that pile of open repair orders your controller is bugging you about.

Eliminate Wait Times and Improve Your CSI Score

The long wait at the front desk at the end of the day? Gone. Customers can pay from anywhere. When they show up, it’s just a quick key hand-off. Honda & Toyota of Seattle saw 75% of their service bills paid on mobile after switching. Think about what that does for your customer satisfaction scores. Happy customers mean an improved CSI. Simple as that.

Free Up Your Service Advisors

How many hours do your advisors waste every month chasing payments or running back and forth to the cashier? With text to pay, that time is recovered. They can focus on what brings in real value: advising customers and driving more revenue through the shop. It's the perfect way to reduce your fixed ops staff workload easily.

Look More Professional

Honestly, asking a customer to read their credit card number over the phone feels ancient. It’s clunky and insecure. A clean, secure text payment link makes the experience feel as modern as the cars you sell. It shows you respect their time and their security.

Numbers don’t lie. Look at Mercedes-Benz Langley.

They had a risky situation: a remote customer with a big repair bill who wanted to pay online and pick up after hours. It smelled like fraud.

But they used Kimoby Service Lane OS with Kimoby Pay. When the customer tried to use a stolen credit card, the system’s fraud detection flagged it instantly. The transaction was blocked, the vehicle wasn’t released, and the dealership avoided a $21,219 chargeback.

On top of that, 52% of their regular customers now choose to pay with their phone via the link they receive by text. It not only prevents disaster, but it’s also the payment method people actually prefer to use.

What to Look For in a Text to Pay Solution

Now that you know the benefits, you need to know what to look for in a SMS payment solution. Not all these systems are built the same. Think of it like speccing a new truck-get the right package now, or you’ll regret it later.

Here’s your checklist. If a vendor can’t check these boxes, keep looking.

Here it is in a clean, copy-ready table:

|

What to Look For |

Why It Matters on the Service Drive |

|---|---|

|

Bullet-Proof Security (PCI Compliant) |

Phone payments can leak card numbers. You need a system that’s locked down to protect you and your customer. It's part of a bigger picture of digital professionalism, which also includes understanding compliance rules like dealership TCPA regulations. |

|

All Major Payment Methods |

Apple Pay, Google Pay, Amex, Visa, Mastercard, and debit. Accept them all so you never lose a payment. |

|

Next-Day Deposits |

Cash flow is king. Money should hit your bank in 1–2 business days, no exceptions. |

|

Real-Time Dashboards |

See who paid, who hasn’t, and what’s coming in without digging through spreadsheets. |

|

Seamless DMS Integration |

The system must talk to your DMS to close ROs automatically and keep records clean, no manual entry. |

|

Built-in Financing Options |

A customer hesitating on a $2,000 job? A “Pay with Affirm” button in the text often turns a “no” into a “yes". This simple option is one of the most effective way to increase your average repair order revenue. |

|

Easy Refunds & Dispute Help |

Chargebacks happen. One-click refunds and clear tracking keep them from becoming all-day projects. |

Text to Pay Templates You Should Use for Your Dealership

Okay, so you’re on board. But what do you actually text your customers? Keep it simple, professional, and direct. Here are a few templates you can use tomorrow.

For Payment Request:

For the End-of-Day Rush:

For Payment Confirmation:

{advisor.name}

Conclusion

At the end of the day, running a dealership is about efficiency and customer experience. The old way of taking payments is slow, insecure, and frustrating for everyone involved.

Text to pay fixes that. It gets you paid faster, makes your customers happier, and frees up your team to do more productive work. It turns that painful last step of the service visit into a painless one.

You’re losing time and money every day you stick with the 5 PM pile-up.

Ready to see what this could look like for your store? Let’s hop on a quick demo to show you how it works.

Frequently Asked Questions (FAQ)

Is text to pay secure?

Yes, 100%. Reputable text to pay platforms use PCI-compliant, encrypted connections. It’s infinitely more secure than having an advisor write down a credit card number on a piece of paper or take it over a recorded phone line.

What if my customers aren’t tech-savvy?

You’d be surprised. If they can open a text message and tap a link, they can use text to pay. It’s often easier for them than finding their wallet and reading a card number. Plus, with adoption rates of over 50-70% at many dealerships, it’s clear that customers of all ages prefer the convenience. An easy way to improve customer retention.

What’s this going to cost me?

Most platforms operate on a standard transaction fee, similar to your regular merchant processor. The real question is what it costs you not to have it-in wasted advisor hours, delayed payments, and lower CSI scores. The ROI from freeing up just one service advisor for an extra hour a day is massive.

How does this work with my existing DMS?

The best systems are built to integrate seamlessly. A payment made via text should automatically update the repair order in your DMS (like CDK, Reynolds & Reynolds, etc.), marking it as paid and closing it out.

Does this help with chargebacks?

Absolutely. The digital trail is your best friend. With a record of the sent link, the opened invoice, and the digital payment authorization, you have much stronger evidence to fight an unjust chargeback compared to a simple signature on a paper invoice.

You May Also Like

These Related Stories

How to Reduce Service Lane Wait Lines and Fraud

Choosing the Right CRM for Your Car Dealership

/photo_honda_toyota_seattle_busy_service.png)